Kicking off with crypto coins for 2025, the financial landscape is poised for significant changes as emerging technologies and evolving regulations reshape how we perceive digital currencies. As more investors and institutions embrace cryptocurrencies, understanding the key players and trends will be crucial for navigating this dynamic market.

In this discussion, we will delve into the anticipated market trends, major cryptocurrencies expected to dominate, and the innovations that may impact their value. We’ll also explore the regulatory landscape and provide investment strategies, ensuring you’re well-equipped for the evolving world of crypto coins.

Overview of Crypto Coins for 2025

The financial landscape is rapidly evolving, with cryptocurrencies playing a pivotal role in shaping the future of transactions, investments, and overall economic interaction. By 2025, crypto coins are anticipated to solidify their position as essential instruments in both personal and institutional finance. This article explores the significance of these digital assets, market trends, and the factors propelling their adoption.Market trends suggest a growing integration of cryptocurrencies into mainstream finance, driven by innovations in technology and shifts in investor behavior.

The increasing acceptance of digital currencies by businesses and regulatory bodies alike highlights a significant turning point for the crypto market. Factors such as the global push for digitalization, inflation concerns, and the quest for alternative investment avenues are expected to fuel the adoption of crypto coins.

Major Players in the Crypto Market

As we approach 2025, several cryptocurrencies are poised to dominate the market, primarily Bitcoin and Ethereum, which have established themselves as leading players. These coins have not only shown resilience but have also witnessed substantial growth in market capitalization. A comparative analysis of market performance over the past few years reveals that Bitcoin continues to lead in value, while Ethereum showcases its unique proposition with smart contracts and decentralized applications.

Emerging cryptocurrencies such as Solana and Cardano are gaining traction due to their innovative features and scalability.

Technological Innovations Impacting Crypto

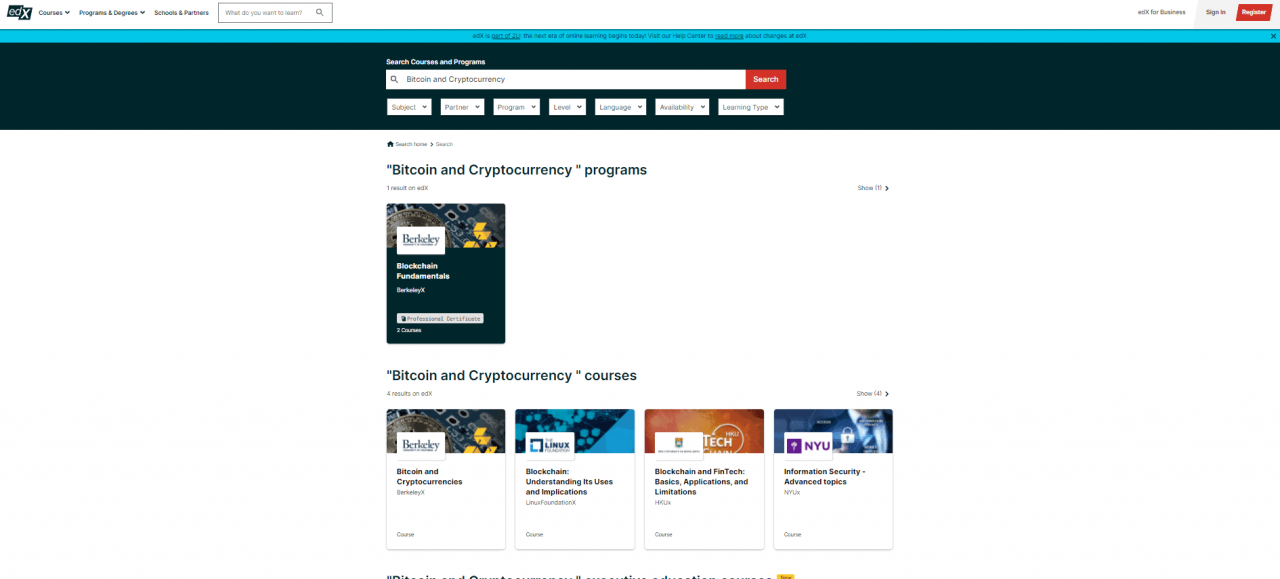

Technological advancements are set to redefine the crypto landscape by 2025. Innovations such as Layer 2 solutions, zero-knowledge proofs, and interoperability protocols are expected to enhance transaction efficiency and security. Blockchain technology remains at the core of cryptocurrency evolution, enabling decentralized finance (DeFi) applications and non-fungible tokens (NFTs) to flourish. The following table highlights some innovative projects and technologies that are reshaping the crypto space:

| Project | Technology | Description |

|---|---|---|

| Ethereum 2.0 | Proof of Stake | Transition to a more energy-efficient consensus mechanism. |

| Polkadot | Multi-chain | Facilitates interoperability between different blockchains. |

| Chainlink | Oracle Network | Connects smart contracts with real-world data. |

Regulatory Landscape

The regulatory environment for cryptocurrencies is evolving rapidly, with significant implications for market dynamics by 2025. Countries such as the United States, the European Union, and China are leading the way in establishing comprehensive frameworks to govern crypto activities.Key changes in regulations could include clearer guidelines on taxation, anti-money laundering (AML) practices, and consumer protection measures. Crypto investors should stay informed and adapt their strategies to navigate these potential regulatory challenges effectively.

Investment Strategies

Investing in crypto coins requires well-thought-out strategies, especially as the landscape becomes more competitive. Effective investment strategies leading up to 2025 should include thorough research, understanding market trends, and strategic entry and exit points.To mitigate risks associated with crypto investments, consider the following techniques:

- Diversifying your portfolio across different asset classes.

- Setting strict stop-loss limits to minimize potential losses.

- Regularly reviewing and adjusting your investment strategy based on market conditions.

- Staying informed about technological and regulatory changes that may impact the market.

Environmental Considerations

The environmental impact of cryptocurrency mining has become a significant concern. Traditional mining operations often consume vast amounts of energy, leading to increased carbon footprints. In response, the industry is increasingly adopting sustainable practices, such as utilizing renewable energy sources and developing eco-friendly consensus mechanisms. A comparison of the ecological footprints of different cryptocurrencies reveals a growing trend towards sustainability, with coins like Cardano and Algorand leading the charge in energy-efficient blockchain operations.

Future Predictions

Predictions for the value trajectory of major crypto coins by 2025 suggest continued growth, with Bitcoin projected to potentially reach new all-time highs, while Ethereum’s value may increase significantly due to its expanding use cases. Market scenarios could vary widely, with best-case outcomes envisioning mass adoption and mainstream integration of cryptocurrencies, while worst-case scenarios might involve stringent regulations that hinder growth.

Observing trends in user adoption, increased transaction volumes, and heightened interest in decentralized finance will be crucial indicators of the market’s health.

Case Studies

Successful crypto projects have had a profound impact on the market, demonstrating the potential for innovation within the industry. For instance, the rise of DeFi platforms like Uniswap has transformed traditional trading mechanisms, providing users with unprecedented access to liquidity.The following table showcases historical performance and forecasts for various crypto coins, illustrating their growth trajectories and potential future value:

| Cryptocurrency | 2020 Price | 2025 Forecast |

|---|---|---|

| Bitcoin | $29,000 | $100,000+ |

| Ethereum | $700 | $10,000+ |

| Solana | $1.50 | $300+ |

Lessons learned from past crypto market cycles emphasize the importance of resilience and adaptability in investment strategies. By analyzing historical data and understanding the factors influencing market fluctuations, investors can make more informed decisions in the ever-changing landscape of cryptocurrencies.

Final Summary

In summary, as we look ahead to 2025, the world of crypto coins is set to undergo transformative changes influenced by technology, regulation, and market forces. By staying informed and adaptable, investors can seize opportunities while mitigating risks in this exciting financial frontier.

Commonly Asked Questions

What are the top cryptocurrencies to watch in 2025?

Bitcoin, Ethereum, and emerging coins like Cardano and Solana are anticipated to be significant players in 2025.

How can I safely invest in crypto coins?

Utilizing diversified portfolios and implementing risk management techniques can enhance the safety of crypto investments.

What impact will regulations have on the crypto market?

Regulatory changes could reshape the market by influencing investor confidence and operational frameworks for cryptocurrencies.

Are there eco-friendly options in cryptocurrency?

Yes, several cryptocurrencies are adopting sustainable practices to minimize their environmental impact, making them more appealing to eco-conscious investors.

What factors affect the value of crypto coins?

Market demand, technological advancements, regulatory developments, and investor sentiment are key factors influencing crypto coin values.