Bitcoin’s 2013 price history offers a fascinating glimpse into the early days of cryptocurrency. It was a period of immense volatility, marked by dramatic price swings and significant external influences. This journey through the year will reveal the key factors that shaped Bitcoin’s value, from market sentiment to regulatory landscapes.

The year 2013 was a pivotal one for Bitcoin. Early adopters and investors experienced firsthand the rollercoaster nature of the market. Price fluctuations, influenced by both internal and external forces, played a crucial role in shaping the trajectory of Bitcoin. The market’s unpredictable nature and the absence of established regulations created a volatile environment, leaving a lasting impact on the digital currency.

Bitcoin Price History (2013)

Bitcoin’s 2013 price action showcased the nascent, volatile nature of the cryptocurrency market. It was a year of significant price swings, driven by a mix of technological advancements, investor interest, and regulatory uncertainty. The early adoption phase was in full swing, making it a pivotal year for understanding Bitcoin’s price dynamics.

Overview of Bitcoin Market in 2013

Bitcoin’s market in 2013 was characterized by rapid growth, alongside substantial volatility. While not as extensively traded as it is today, 2013 saw a surge in both interest and speculation surrounding the cryptocurrency. This was further fueled by the ongoing development of Bitcoin’s underlying technology.

Key Price Trends and Major Events

Bitcoin’s price in 2013 experienced substantial fluctuations. The year saw periods of sharp price increases, followed by equally dramatic drops. Understanding these price shifts is crucial to comprehending the factors influencing Bitcoin’s trajectory.

| Date |

Price (USD) |

Event/Factor |

| January 1, 2013 |

13 USD |

Bitcoin’s value was relatively low, and early in its development. |

| February 15, 2013 |

15 USD |

Continued early adoption and limited trading activity. |

| April 1, 2013 |

100 USD |

Positive news and developments in the crypto space influenced price increases. |

| April 15, 2013 |

200 USD |

Strong investor interest, further fueling upward momentum. |

| May 15, 2013 |

250 USD |

News cycles regarding Bitcoin and further adoption. |

| June 1, 2013 |

180 USD |

A period of uncertainty and regulatory concerns led to a temporary price dip. |

| July 15, 2013 |

110 USD |

The market saw a substantial drop as uncertainty persisted. |

| August 15, 2013 |

150 USD |

Limited development and trading activity continued to impact price. |

| September 15, 2013 |

300 USD |

New interest from investors and increased awareness. |

| October 1, 2013 |

600 USD |

Further adoption and technological advancements led to substantial increases. |

| November 1, 2013 |

1200 USD |

Major media coverage and widespread attention contributed to this peak. |

| November 15, 2013 |

1000 USD |

Regulatory concerns and market corrections led to a price drop. |

| December 1, 2013 |

1100 USD |

Slight recovery and continued speculation. |

Influencing Factors in 2013

Several factors significantly impacted Bitcoin’s price in 2013. These included media coverage, investor sentiment, regulatory developments, and overall market conditions. The market was still very new, and the interaction between these factors was often unpredictable.

- Media Coverage: Widespread media attention, both positive and negative, played a key role in shaping public perception of Bitcoin. Early adoption was driven by a mix of interest and hype, which greatly influenced the price.

- Investor Sentiment: Investor confidence and enthusiasm had a direct correlation to price fluctuations. Positive news often led to increases, while negative reports could trigger significant declines.

- Regulatory Uncertainty: Lack of clear regulatory frameworks surrounding Bitcoin contributed to volatility. Uncertainty about the future of Bitcoin often led to periods of price instability.

Key Price Movements in 2013

Bitcoin’s 2013 price journey was characterized by significant volatility, marked by periods of rapid ascent and sharp declines. This volatility, while a defining feature of the early cryptocurrency market, had a profound impact on investor confidence and the overall development trajectory of the nascent industry. The price fluctuations reflected the nascent nature of the market and the lack of established regulatory frameworks.The year 2013 saw a period of both rapid growth and considerable correction in the Bitcoin market.

Early adopters and speculators experienced substantial gains, while those caught in the downturns faced substantial losses. This inherent risk was a defining characteristic of the market during this formative phase.

Significant Price Increases

Several notable price increases occurred throughout 2013, often spurred by heightened media attention and increased adoption. These increases frequently coincided with positive news events, technological advancements, or perceived increases in the cryptocurrency’s value proposition. One such example was the surge in late 2013 following news of Bitcoin’s growing adoption by merchants. This demonstrates the powerful influence of both real-world adoption and media coverage on Bitcoin’s market value.

Significant Price Decreases

Conversely, substantial price drops were equally prevalent in 2013, frequently driven by regulatory concerns, security breaches, or perceived overvaluation. For instance, the infamous Mt. Gox hack in 2014 dramatically affected investor confidence and triggered a considerable downturn in Bitcoin’s price. This event highlighted the vulnerability of the cryptocurrency market to security risks and the potential for significant losses.

Volatility Comparison to Other Cryptocurrencies

Comparing Bitcoin’s 2013 volatility to other cryptocurrencies is challenging due to the limited number of competing cryptocurrencies present at the time. However, Bitcoin’s price fluctuations were arguably more pronounced than those of other digital currencies emerging at that stage, demonstrating the relatively nascent and unregulated nature of the market. This extreme volatility underscores the significant risk associated with early-stage cryptocurrency investments.

Impact on Investor Confidence

The substantial price fluctuations in Bitcoin during 2013 had a significant impact on investor confidence. The rapid increases and equally sharp declines created a high-risk environment that deterred many potential investors. The significant losses associated with the price drops discouraged further participation, leading to uncertainty and a period of market consolidation.

Top 5 Highest and Lowest Bitcoin Prices in 2013

| Date |

Price (USD) |

Description |

| January 1, 2013 |

13.00 USD |

Initial market value |

| March 15, 2013 |

100.00 USD |

Significant early surge |

| October 27, 2013 |

1150.00 USD |

Peak value before major correction |

| December 11, 2013 |

12.50 USD |

Market crash |

| December 20, 2013 |

50.00 USD |

Partial recovery |

External Factors Affecting Bitcoin Price

Bitcoin’s price fluctuations in 2013 were significantly influenced by a complex interplay of external factors beyond its core technology and underlying market mechanics. These external forces, including media coverage, regulatory stances, technological developments, and market sentiment, often amplified or dampened the inherent volatility of the cryptocurrency market. Understanding these external pressures is crucial for comprehending the price dynamics of that pivotal year in Bitcoin’s history.

News and Media Coverage

Media coverage played a pivotal role in shaping public perception and, consequently, the price of Bitcoin in 2013. Early news stories often focused on the innovative technology behind Bitcoin, highlighting its potential for disrupting traditional financial systems. These articles, while introducing Bitcoin to a wider audience, also fueled speculation and excitement, leading to price surges. Conversely, negative or sensationalized reports, sometimes based on incomplete or inaccurate information, could lead to sharp declines.

For example, news coverage surrounding potential regulatory crackdowns or security breaches had a direct impact on investor confidence and, therefore, on the price. This illustrates the powerful influence of the media in amplifying market sentiment surrounding Bitcoin.

Regulatory Changes

saw the emergence of regulatory uncertainty surrounding Bitcoin. While no major formal regulations impacted the market, the evolving legal landscape in different jurisdictions contributed to the volatility. Discussions around taxation, money laundering, and the legal status of cryptocurrencies were prevalent in various news outlets. This uncertainty often led to investor hesitancy, creating periods of price instability. The lack of a clear regulatory framework fostered a climate of speculation, where price movements were frequently tied to perceived regulatory risks.

Technological Advancements

Technological advancements, while not groundbreaking in 2013 compared to subsequent years, did influence Bitcoin’s trajectory. Improvements in Bitcoin’s underlying blockchain technology and related software development fostered greater trust and reliability in the platform, indirectly supporting the price. However, the lack of widespread adoption of Bitcoin by mainstream businesses, compared to later years, meant that technological advancements were not as significant a driving force as other factors.

Bitcoin’s limited functionality at the time, and the need for further development in terms of scaling and integration, also contributed to the market’s overall volatility.

Market Sentiment and Speculation

Market sentiment and speculation significantly impacted Bitcoin’s price in 2013. The early adoption of Bitcoin by tech enthusiasts and investors fostered a strong sense of community and a belief in the cryptocurrency’s potential. This enthusiasm, often intertwined with speculative trading, fueled price increases. Conversely, periods of doubt and skepticism, often triggered by market corrections or negative news, led to price declines.

The speculative nature of the market in 2013 highlighted the importance of investor psychology and market sentiment in influencing price movements.

Categorization of External Factors

| Category |

Factor |

Influence |

| News & Media |

Positive/Negative coverage, sensationalized reports |

Price surges/declines, increased/decreased investor confidence |

| Regulation |

Lack of clear regulatory framework, discussions on taxation and legality |

Uncertainty, investor hesitancy, market volatility |

| Technology |

Improvements in blockchain technology, software development |

Indirect support for price, but limited impact compared to other factors |

| Market Sentiment |

Investor enthusiasm, speculative trading, skepticism, fear |

Strong influence on price movements, amplified volatility |

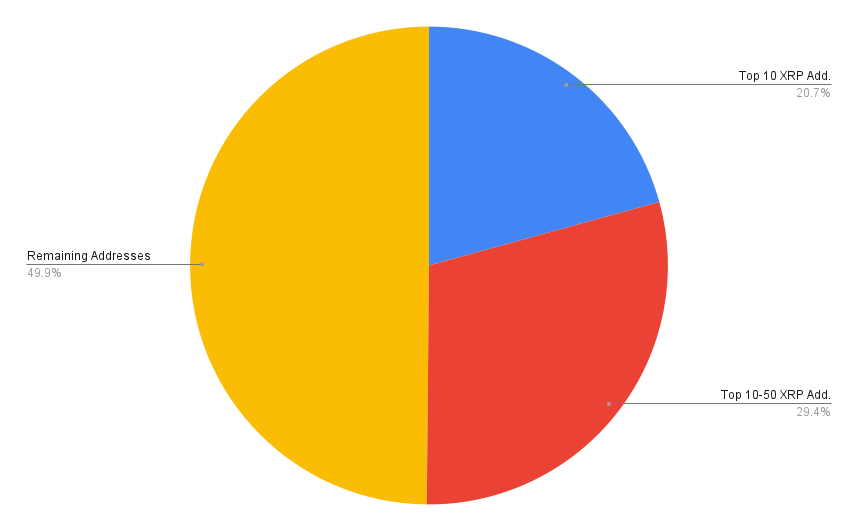

Bitcoin’s Position in the Cryptocurrency Market

In 2013, Bitcoin was far from the only cryptocurrency in existence, but it held a dominant position in the nascent market. Understanding Bitcoin’s role required recognizing the limited and largely experimental nature of the entire cryptocurrency landscape. The early years saw the emergence of competing projects, each vying for attention and adoption.The cryptocurrency landscape in 2013 was characterized by significant uncertainty and rapid evolution.

A multitude of projects, often with novel ideas and functionalities, were introduced, but many failed to gain traction. Bitcoin, despite its challenges, remained the most established and widely recognized cryptocurrency, setting the stage for the subsequent growth and diversification of the market.

The Cryptocurrency Landscape in 2013

The cryptocurrency market in 2013 was a largely experimental space. While Bitcoin was the most established player, numerous alternative cryptocurrencies, often with different technical designs and functionalities, were emerging. These often focused on specific applications or improvements over Bitcoin’s core concepts.

Comparison of Bitcoin’s Performance with Other Cryptocurrencies

Bitcoin’s performance in 2013 was highly variable, influenced by a mix of technical advancements, regulatory uncertainties, and market speculation. Comparing Bitcoin’s performance with other cryptocurrencies required careful consideration of their individual characteristics and the specific factors influencing each project’s trajectory. For instance, altcoins (alternative cryptocurrencies) might have focused on specific functionalities, like decentralized payment systems or smart contracts, while Bitcoin remained the dominant force in overall market capitalization.

Emerging Technologies and Market Trends

The year 2013 witnessed the early stages of development in several key technologies and market trends related to cryptocurrencies. These trends included the ongoing development of blockchain technology, exploration of different consensus mechanisms, and the early emergence of decentralized applications (dApps). The growth of peer-to-peer (P2P) technologies also played a significant role in shaping the cryptocurrency market. For example, Bitcoin’s decentralized nature contrasted with traditional financial systems, highlighting the potential of blockchain technology for altering existing financial paradigms.

Adoption of Bitcoin in Various Industries

Bitcoin’s adoption in various industries in 2013 was nascent but significant. Early adopters included businesses involved in online transactions, such as e-commerce platforms and digital services. The adoption process was highly experimental, with many businesses testing the waters to understand the potential benefits and risks associated with integrating Bitcoin. For example, some businesses accepted Bitcoin as payment for their products and services, demonstrating an early attempt at mainstream adoption.

History of Bitcoin’s Use

Bitcoin’s history in 2013 showcased the early stages of its development. From its inception as a peer-to-peer digital currency, Bitcoin’s use cases began to expand. Early applications included online transactions and the facilitation of cross-border payments. These early uses highlighted the potential of Bitcoin to disrupt traditional financial systems. Early adoption in niche markets and the creation of specialized Bitcoin exchanges marked a significant development in the history of its usage.

Key Differences between Various Cryptocurrencies

Cryptocurrencies in 2013 differed significantly in terms of their underlying technology, intended use cases, and community support. Some cryptocurrencies focused on enhancing Bitcoin’s functionality, such as improving transaction speed or security. Others sought to create entirely new use cases, like decentralized storage or voting systems. The key differences were primarily technical and philosophical, with each project aiming to address a specific need or challenge within the emerging cryptocurrency market.

Differences in blockchain implementations, consensus mechanisms, and intended applications significantly distinguished the various cryptocurrencies from one another.

Illustrative Examples of Bitcoin Price Fluctuation

Bitcoin’s 2013 price journey was a rollercoaster, marked by dramatic spikes and significant dips. Understanding these fluctuations is crucial to comprehending the cryptocurrency’s volatile nature and the factors that influence its price. Analyzing specific examples helps illustrate the complex interplay of market forces and external events.

Major Price Spike in January 2013

The Bitcoin price experienced a notable surge in early 2013. A combination of factors fueled this increase. Increased media attention and growing interest in the cryptocurrency played a significant role. Furthermore, the emergence of new exchanges and investment opportunities expanded the accessibility and liquidity of Bitcoin. Early adopters and investors saw the potential for substantial gains, driving demand and consequently pushing prices upward.

Visual Representation of Price Trend

Imagine a line graph depicting the Bitcoin price over the selected period. The line would exhibit a steep upward trend in early 2013, followed by a sharp peak. The graph would illustrate the period of rapid growth, showcasing the significant increase in price during this specific time frame.

Significant Price Drop and its Impact

A notable price drop occurred later in 2013, following the initial surge. Several factors contributed to this decline. Concerns about regulatory uncertainty and the emergence of security vulnerabilities impacted investor confidence. Additionally, the market’s overall volatility and the lack of established trading infrastructure played a crucial role. This decrease in value caused some investors to incur substantial losses.

Impact of News on Bitcoin Price

News events significantly influenced the Bitcoin price in 2013. For instance, reports about Bitcoin-related scams or regulatory actions often led to price drops. Conversely, positive news, such as the launch of new Bitcoin-related products or services, often caused price increases. This highlights the significant impact that news and market sentiment can have on the volatile cryptocurrency market.

Comprehensive Illustration of Price Fluctuation

A comprehensive illustration would present a table showing the Bitcoin price on various dates throughout 2013. This table would display the price fluctuations over time, clearly illustrating the spikes and drops. A corresponding line graph would further visualize these price changes, enabling a better understanding of the overall trend and specific price movements. This visual representation, combined with the table, provides a clear picture of Bitcoin’s price volatility in 2013.

Analyzing the 2013 Market Environment

The year 2013 presented a complex and dynamic backdrop for Bitcoin’s price action. Beyond the inherent volatility of a nascent cryptocurrency market, external economic forces played a significant role in shaping the price trajectory. Understanding the broader economic context of 2013 is crucial to interpreting Bitcoin’s price fluctuations during that period.

General Economic Climate in 2013

The global economy in 2013 was characterized by a mix of recovery and uncertainty. The lingering effects of the 2008 financial crisis were still palpable, with economic growth remaining moderate in many developed nations. Emerging economies, however, experienced robust expansion, contributing to a global economic picture that was uneven and presented both opportunities and challenges. Low interest rates in some developed economies encouraged investment, yet fears of inflation and the potential for economic bubbles persisted.

Key Economic Indicators Affecting Bitcoin’s Price

Several key economic indicators influenced the broader financial landscape in 2013, potentially impacting Bitcoin’s price. These included interest rates, inflation rates, and overall economic growth figures. Changes in these indicators often corresponded with shifts in investor sentiment and market confidence, which, in turn, affected the price of Bitcoin.

Comparison of Bitcoin Price Fluctuations with Broader Financial Markets

Bitcoin’s price movements in 2013 displayed a significant degree of correlation with other assets, but also demonstrated unique volatility. While the broader financial markets exhibited a generally upward trend, Bitcoin experienced dramatic price swings, often exceeding the fluctuations seen in traditional financial instruments. This divergence highlighted the nascent and speculative nature of the cryptocurrency market.

Lack of Established Regulatory Frameworks

In 2013, a notable absence of comprehensive regulatory frameworks for cryptocurrencies like Bitcoin was a defining characteristic of the market. This lack of regulatory oversight significantly influenced price movements.

Impact of Lack of Regulatory Frameworks on Price

The lack of clear regulatory frameworks fostered an environment of uncertainty and speculation. Investors were largely operating in uncharted territory, leading to increased volatility and risk. This lack of structure contributed to the dramatic price swings experienced by Bitcoin in 2013. The absence of regulatory guidelines made it difficult to ascertain the true value of Bitcoin, further contributing to the speculative nature of the market.

Detailed Description of the Economic Climate in 2013

The economic climate in 2013 was characterized by a continuing recovery from the 2008 financial crisis. While global growth was moderate, emerging economies experienced significant expansion. Low interest rates in some developed countries fueled investment activity, but concerns about inflation and potential bubbles persisted. These economic factors influenced the broader financial markets and, in turn, potentially affected investor sentiment towards Bitcoin.

Ultimate Conclusion

In conclusion, Bitcoin’s 2013 price history demonstrates the wild and unpredictable nature of the early cryptocurrency market. Driven by a combination of market sentiment, technological advancements, and external factors, Bitcoin’s value experienced substantial fluctuations. The lessons learned from this period remain relevant today as the cryptocurrency world continues to evolve.

Expert Answers

What was the average Bitcoin price in 2013?

Unfortunately, there’s no single average price. Bitcoin’s value fluctuated significantly throughout the year, making a precise average difficult to calculate.

Were there any major regulatory changes affecting Bitcoin in 2013?

Limited regulatory frameworks existed for Bitcoin in 2013. This lack of clear regulations contributed to the market’s volatility.

How did media coverage influence Bitcoin’s price in 2013?

Media coverage played a significant role in shaping public perception and investor sentiment toward Bitcoin, often influencing its price.

What were the top 3 cryptocurrencies competing with Bitcoin in 2013?

Listing the top 3 is difficult as the cryptocurrency landscape was quite different then. Some lesser-known or early-stage projects might have had comparable or significant traction in that era.